What Is the Digital Operational Resilience Act (DORA)?

The Digital Operational Resilience Act (DORA) is a regulation enacted by the European Union to enhance the operational resilience of financial entities. It aims to ensure that financial institutions can withstand, respond to, and recover from all types of operational disruptions. DORA covers a wide range of measures including risk management, cybersecurity, and incident reporting.

DORA introduces requirements for financial entities to establish risk management programs. These programs involve assessing risks, implementing controls, and continuously monitoring for vulnerabilities. Financial institutions need to demonstrate their preparedness in managing operational risks, including those arising from third-party services. Additionally, DORA mandates incident reporting mechanisms, ensuring that any major disruptions are promptly communicated to supervisors.

This is part of a series of articles about DORA regulation.

Table of Contents

ToggleWhich Organizations Must Comply with the DORA Requirements?

DORA applies to a broad range of financial entities, including banks, insurance companies, investment firms, and payment service providers. It also extends to critical third-party service providers such as cloud services and data analytics firms. The regulation encompasses any organization that plays a role in the stability and integrity of the financial system, ensuring that the resilience measures are uniformly applied.

Medium and smaller enterprises within the financial sector are not exempt from DORA’s regulations. These entities must also comply with the set standards, albeit with some scale-based adjustments. The regulator’s goal is to ensure every participant adheres to operational resilience standards, safeguarding the financial landscape from systemic risks.

The Connection Between DORA Requirements and IT

Here are a few ways DORA compliance impacts a financial organization’s IT systems:

IT Risk Management

IT risk management is a fundamental component of DORA compliance. Financial entities must establish risk management frameworks that identify, assess, and mitigate IT-related risks. This involves regular vulnerability assessments, implementing security controls, and having contingency plans in place. Effective IT risk management ensures that institutions are prepared for potential threats, minimizing downtime and operational impact.

Additionally, DORA mandates continuous monitoring and review of IT systems to identify emerging risks promptly. Financial entities should employ analytics and automated tools to detect anomalies and potential security breaches. Regular audits and assessments are crucial in ensuring compliance with DORA requirements.

Cybersecurity

Cybersecurity under DORA involves implementing measures to protect against cyber threats. Financial entities are required to adopt multi-layered security protocols, including encryption, firewalls, and intrusion detection systems. These measures aim to safeguard sensitive data and maintain the integrity of financial operations against various cyber-attacks.

Institutional cybersecurity practices must also extend to employee training and awareness programs. DORA emphasizes the human element in cybersecurity, advocating for regular training sessions to equip staff with knowledge on identifying phishing attempts and other cyber threats.

Operational Resilience Testing

Operational resilience testing is vital for ensuring readiness against disruptions under DORA. Financial institutions must conduct regular stress tests and scenario analyses to assess their ability to withstand operational challenges. These tests simulate various types of disruptions, from cyber attacks to natural disasters, allowing entities to evaluate their response capabilities and identify potential weaknesses.

The insights gained from these tests help institutions refine their operational resilience strategies. Continuous improvement based on testing outcomes ensures that financial institutions are not only compliant with DORA’s requirements but also prepared to maintain operations during unforeseen events.

Third-Party IT Service Providers

DORA places significant emphasis on managing third-party IT service providers. Financial entities must ensure that their service providers comply with the same standards of operational resilience. This includes due diligence processes, regular audits, and the establishment of contractual agreements outlining service continuity and risk management obligations.

Monitoring and managing third-party risks is crucial for maintaining operational integrity. Financial institutions are required to implement mechanisms for continuous oversight of their third-party providers. Ensuring that these providers adhere to DORA’s resilience standards helps mitigate risks associated with outsourced services.

Information Sharing

Information sharing is a critical element of DORA, promoting collaboration among financial institutions. Entities are encouraged to share relevant incident information, threat intelligence, and best practices to collectively enhance resilience. This collaborative approach facilitates a faster and more informed response to cyber threats and operational disruptions.

Effective information sharing also involves establishing formal mechanisms for communication between entities and regulatory bodies. Regular reporting and updates ensure that supervisors are aware of the operational resilience status and any emerging threats. This transparency helps in coordinating a unified response to potential disruptions.

Governance and Compliance

Governance and compliance are central to DORA’s implementation. Financial entities must establish governance structures that oversee their operational resilience efforts. This includes defining clear roles and responsibilities, ensuring that senior management and board members are actively involved in resilience planning and decision-making processes.

Compliance with DORA requires a structured approach to monitoring and reporting. Financial institutions must regularly assess their compliance status and address any identified gaps promptly. Internal audits, automated compliance monitoring tools, and regular reviews help in maintaining adherence to DORA’s regulations, ensuring that institutions are always prepared to meet regulatory expectations.

Lanir specializes in founding new tech companies for Enterprise Software: Assemble and nurture a great team, Early stage funding to growth late stage, One design partner to hundreds of enterprise customers, MVP to Enterprise grade product, Low level kernel engineering to AI/ML and BigData, One advisory board to a long list of shareholders and board members of the worlds largest VCs

Tips from the Expert

In my experience, here are tips that can help you improve DORA compliance:

- Develop a comprehensive asset inventory Establish a detailed inventory of all IT assets, including hardware, software, and data. This aids in identifying critical components that need prioritized protection and facilitates more accurate risk assessments.

- Automate compliance checks Implement automated tools for continuous compliance monitoring. Automation reduces human error and ensures that your organization consistently meets DORA’s regulatory requirements.

- Integrate cyber resilience into business strategy Ensure that cyber resilience is a core component of your overall business strategy. This alignment ensures that senior management prioritizes and invests appropriately in resilience measures.

- Enhance data encryption practices Regularly update and strengthen your data encryption protocols. Ensure that data at rest and in transit are encrypted with the latest algorithms to protect against unauthorized access and data breaches.

- Conduct regular red team exercises Perform regular red team exercises where an internal or external team simulates attack scenarios. This practice helps in identifying weaknesses in your defenses and improving your incident response strategies.

IT and DORA Compliance: Challenges and Solutions

Complexity of IT Environments

One of the primary challenges in achieving DORA compliance is the complexity of modern IT environments. Financial institutions often operate a mix of on-premise systems, cloud infrastructures, and hybrid setups. Managing operational resilience across these varied environments requires a comprehensive approach to risk management, monitoring, and incident response. The complexity increases when different systems and platforms interact, leading to potential integration issues or overlooked vulnerabilities.

To address this, institutions should adopt standardized frameworks for risk assessments and incident management that can be applied consistently across all IT environments. Automating processes such as monitoring, vulnerability scanning, and reporting can help in streamlining compliance efforts while reducing human error.

Legacy Systems

Legacy systems pose another significant challenge to DORA compliance. Many financial institutions still rely on outdated technologies that are not equipped to meet modern cybersecurity and resilience standards. These systems may lack proper encryption, are difficult to update, and can introduce security risks that are harder to mitigate.

Migrating from legacy systems to newer, compliant technologies is a long-term solution, but it requires substantial investment and resources. In the short term, financial institutions can implement compensating controls, such as additional layers of security, restricted access, and more frequent monitoring, to mitigate the risks associated with legacy systems.

Resource Constraints

Achieving DORA compliance often demands substantial financial and human resources, which can be challenging for smaller institutions. Implementing and maintaining advanced risk management frameworks, cybersecurity measures, and compliance monitoring tools can stretch budgets and IT teams. Smaller firms may lack the resources to invest in state-of-the-art solutions or hire specialized personnel to oversee compliance efforts.

To overcome these constraints, organizations can prioritize critical areas of DORA compliance, focusing on the most impactful risks first. Additionally, leveraging third-party vendors that offer compliance-as-a-service solutions can help bridge the resource gap, allowing smaller institutions to meet regulatory requirements without needing to build extensive in-house capabilities.

Data Management and Protection

Effective data management is critical for DORA compliance, particularly in terms of ensuring the security and integrity of sensitive financial and customer data. Financial institutions must ensure that their data is adequately protected against breaches, loss, or unauthorized access, both during transmission and storage. However, managing vast amounts of data, especially in multi-cloud environments, increases the risk of misconfigurations and data breaches.

To address these challenges, institutions should implement strong encryption protocols, access controls, and regular audits of their data management practices. Data classification policies that categorize information based on sensitivity can also help in applying appropriate protections where they are most needed.

Shortage of Specialized IT Talent

The shortage of specialized IT talent poses a significant obstacle to achieving DORA compliance. Skilled professionals with expertise in cybersecurity, risk management, and regulatory compliance are in high demand, and many financial institutions struggle to attract and retain the right talent. This shortage can delay the implementation of critical compliance measures and impact the overall resilience of an organization.

Financial institutions can address this issue by investing in the development of their existing IT staff through training programs focused on DORA’s requirements and operational resilience. Outsourcing certain compliance tasks to specialized third-party providers is another option, helping to fill the talent gap without compromising on compliance efforts.

Maintaining Continuity During Cloud Migrations

Cloud migrations are becoming increasingly common as financial institutions move to more scalable and flexible infrastructures. However, maintaining operational continuity and resilience during these migrations is a key challenge under DORA. Migrations often involve temporary disruptions, and there is a risk of data loss, misconfigurations, or security vulnerabilities during the transition phase.

To mitigate these risks, financial institutions should establish detailed migration plans that include comprehensive risk assessments, testing, and contingency strategies. Continuity plans should address potential disruptions, ensuring that operations can continue smoothly even if issues arise during the migration. Regular audits and post-migration reviews are also essential to ensure that the new cloud infrastructure aligns with DORA’s resilience requirements.

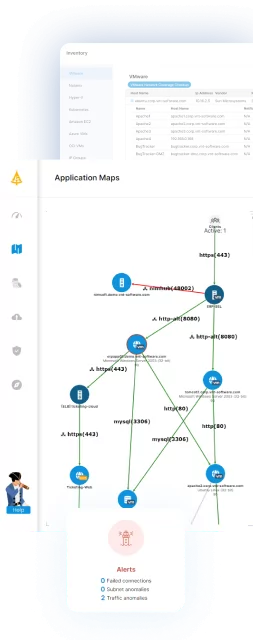

How Faddom Supports DORA Compliance

Navigating DORA compliance can be challenging, especially for organizations with complex IT environments and multiple third-party dependencies. Faddom’s application dependency mapping tool simplifies this process by providing complete visibility across hybrid infrastructures. It automatically discovers and maps all assets, applications, and interdependencies, ensuring a thorough inventory crucial for effective ICT risk management.

Faddom’s real-time monitoring helps identify vulnerabilities and potential risks, enabling proactive incident response and minimizing downtime. Its detailed documentation and reporting features support continuous compliance checks and governance under DORA. By automating these processes, Faddom reduces human error, saving time and resources, and making it easier for organizations to meet DORA’s standards before the 2025 deadline.

Watch our on-demand webinar with a Cybersecurity Expert to learn how our solution supports your compliance journey and reduces risks!