What Is the Digital Operational Resilience Act (DORA) Regulation?

The Digital Operational Resilience Act (DORA) is an EU regulation to bolster the operational resilience of financial entities within the European Union. It aims to standardize digital resilience measures across the financial sector by setting out frameworks for risk management, ensuring that entities can maintain operations during technical disruptions.

DORA’s framework includes requirements for governance, continuous risk monitoring, and cybersecurity measures, emphasizing operational continuity. DORA also insists on incident classification and reporting, mandating that businesses report major incidents quickly to a central authority. This improves transparency and allows regulators to respond to systemic risks.

This is part of a series of articles about DORA regulation

Table of Contents

Toggle- What Is the Digital Operational Resilience Act (DORA) Regulation?

- What Is the Difference Between DORA and the UK Financial Conduct Authority’s (FCA)?

- Understanding DORA Requirements

- Tips from the Expert

- The Impact of EU's DORA on UK Businesses and Opportunities

- Best Practices for UK Business to Comply with DORA Requirements

- Preparing for DORA Compliance with Faddom

What Is the Difference Between DORA and the UK Financial Conduct Authority’s (FCA)?

While the Digital Operational Resilience Act (DORA) shares some similarities with the UK’s Financial Conduct Authority (FCA) guidelines on operational resilience, there are notable differences between the two.

DORA and the FCA’s PS21/3 framework both focus on ensuring that financial institutions can withstand disruptions, but DORA goes further in several areas. For example, DORA applies to a wider range of organizations, including sectors like crypto assets and crowdfunding, which the FCA’s regulations do not currently cover.

Despite some overlap in principles, compliance with one regulation does not yet guarantee compliance with the other. Although it’s possible that these frameworks will become more aligned in the future, for now, UK-based firms must consider both sets of rules separately. This can require additional work, even for organizations that already have resilience measures in place, such as scenario testing and dependency mapping.

Given these complexities, UK firms may benefit from adopting DORA as a benchmark, especially in areas like third-party risk management.

Understanding DORA Requirements

DORA establishes a regulatory framework to ensure financial institutions and their ICT service providers maintain operational resilience. The primary requirements under DORA include:

- ICT risk management: DORA mandates that financial institutions implement an ICT risk management framework. This framework must cover the identification, assessment, and mitigation of ICT risks, integrated with the organization’s governance structures. Regular reviews and updates of these frameworks are necessary to adapt to the evolving threat landscape and maintain compliance with DORA’s standards.

- Third-party risk management: Financial institutions must manage the risks associated with third-party ICT service providers. DORA requires organizations to conduct due diligence, establish clear contractual obligations, and continuously monitor third-party performance. For critical third-party providers, there are additional reporting and oversight requirements, ensuring that these providers adhere to DORA’s standards.

- Operational resilience testing: Organizations must perform annual tests, as well as methods like threat-led penetration testing (TLPT) every three years. These tests help identify potential vulnerabilities, ensuring that businesses can manage operational disruptions and maintain continuity in case of cyber incidents.

- Incident reporting and management: DORA requires financial institutions to develop incident reporting mechanisms. Major ICT incidents must be reported quickly to relevant authorities, allowing for timely responses and minimizing potential damage. Incident management processes should be well-defined, ensuring that disruptions are handled efficiently.

- Information sharing: While not mandatory, DORA encourages information sharing within the financial sector regarding cyber threats and vulnerabilities. This collaborative approach strengthens the overall resilience of the financial system, as sharing intelligence can help mitigate widespread risks.

- Oversight of critical ICT third-party providers: For organizations that rely on critical third-party ICT services, DORA imposes strict oversight requirements. Providers must establish governance frameworks that align with DORA’s rules and have contingency plans in place for managing service disruptions. This oversight ensures that key services remain resilient and that any potential risks are managed.

Learn more in our detailed guide to DORA requirements

Lanir specializes in founding new tech companies for Enterprise Software: Assemble and nurture a great team, Early stage funding to growth late stage, One design partner to hundreds of enterprise customers, MVP to Enterprise grade product, Low level kernel engineering to AI/ML and BigData, One advisory board to a long list of shareholders and board members of the worlds largest VCs

Tips from the Expert

In my experience, here are tips that can help you better adapt to the implications of DORA for UK businesses:

- Proactive third-party audits beyond compliance:

Go beyond DORA’s minimum requirements for third-party oversight by proactively conducting in-depth audits on critical ICT providers. This helps uncover hidden risks and allows for early mitigation strategies that prevent operational surprises, building resilience before problems escalate. - Automate incident detection and reporting:

Implement automation tools for real-time incident detection and reporting to meet DORA’s fast reporting timelines. This reduces manual overhead, shortens response times, and ensures you can meet the stringent deadlines without sacrificing accuracy. - Diversify critical service providers:

Avoid reliance on a single critical ICT provider. Use a diverse range of service providers to reduce concentration risk, making it easier to continue operations in case of a provider failure or disruption. - Align cyber insurance with DORA standards:

Make sure your cyber insurance policies are tailored to DORA’s operational resilience and incident reporting requirements. This ensures that in case of an incident, your coverage matches regulatory demands, minimizing gaps in protection. - Cross-border operational resilience mapping:

For UK companies operating in both the UK and EU markets, conduct detailed cross-border resilience mapping to align systems with both FCA and DORA frameworks. This allows you to streamline dual compliance efforts and avoid duplicate processes.

The Impact of EU’s DORA on UK Businesses and Opportunities

DORA has significant implications for UK businesses, both directly and indirectly, especially those operating within the EU financial sector or providing critical ICT services.

Direct Impact on UK Businesses

For UK financial entities (FEs) and ICT service providers operating within the EU, compliance with DORA is mandatory. This includes implementing frameworks for ICT risk management, ensuring proper incident reporting mechanisms, and performing regular digital operational resilience tests. These companies must also adapt to DORA’s governance and oversight rules for third-party service providers.

UK-based technology providers deemed “critical” under DORA may face direct regulation by EU authorities. In some cases, these companies might need to establish EU-based subsidiaries to meet regulatory requirements, adding complexity to their operational structures.

Indirect Impact on UK Businesses

Even if a UK business does not directly serve financial entities in the EU, it can still be affected by DORA. The regulation requires financial entities to scrutinize their ICT service supply chain, including subcontractors several tiers deep. UK providers without direct EU customers could thus be drawn into DORA’s scope if they supply services for EU financial operations.

DORA’s influence also extends to market access. Complying with the regulation may become a competitive necessity for UK companies looking to maintain or expand their presence in the EU.

Compliance Costs

UK businesses affected by DORA will likely face increased compliance costs. Adapting systems, processes, and frameworks to meet DORA’s requirements may require significant investments. This includes upgrading ICT risk management systems, strengthening third-party risk oversight, and enhancing incident response capabilities.

Opportunities for UK Businesses

DORA also presents growth opportunities for UK businesses, particularly in the technology sector. As financial institutions across the EU strive to comply with DORA, there is a growing demand for ICT solutions that support digital resilience, risk management, and third-party oversight. UK tech firms that can deliver these solutions will be well-positioned to capitalize on this demand.

As the UK continues to establish itself as a global technology hub, organizations with proven expertise in operational resilience may see an advantage. Their reliability and regulatory compliance could become key differentiators in an increasingly competitive market.

Best Practices for UK Business to Comply with DORA Requirements

To meet the requirements of the Digital Operational Resilience Act (DORA), UK businesses must adopt a proactive approach to compliance. By implementing best practices, companies can strengthen their digital resilience, reduce compliance risks, and remain competitive:

- Conduct a gap analysis: Begin by assessing current operational resilience frameworks against DORA’s requirements. This will help identify areas where existing practices fall short. Focus on key aspects like ICT risk management, third-party risk, and incident reporting. Conducting this analysis early allows for prioritizing improvements in line with DORA’s compliance deadlines.

- Enhance ICT risk management: Establish an ICT risk management framework that meets DORA’s standards. This includes continuous monitoring and regular reviews of IT systems, identifying emerging risks, and implementing controls to mitigate them. UK businesses should also ensure that risk management is integrated into broader governance structures.

- Strengthen third-party oversight: UK companies must enhance oversight of third-party ICT providers. This involves conducting due diligence, formalizing contractual obligations, and continuously monitoring performance. Establish clear procedures for assessing third-party resilience, particularly for critical service providers, and ensure they comply with DORA’s requirements.

- Implement regular resilience testing: Financial institutions and ICT providers should implement both annual testing of ICT systems and more advanced testing, such as threat-led penetration testing (TLPT). These tests should simulate real-world disruptions to ensure operational continuity and identify vulnerabilities before they can be exploited.

- Develop and formalize incident response plans: Ensure there are processes in place for managing and reporting major ICT incidents. Establish clear protocols for escalating incidents, notifying relevant authorities, and mitigating potential damage. Regularly review and test these plans to ensure they remain effective.

- Leverage information sharing networks: Although not mandatory, sharing information about cyber threats and vulnerabilities with industry peers can be a useful practice. By collaborating with others in the financial sector, UK businesses can stay ahead of emerging threats.

- Monitor regulatory changes: DORA’s framework is still evolving, and further guidance from EU authorities may be issued. UK businesses should closely monitor these changes and adjust their compliance strategies accordingly. This will ensure they remain aligned with both current and future regulatory expectations.

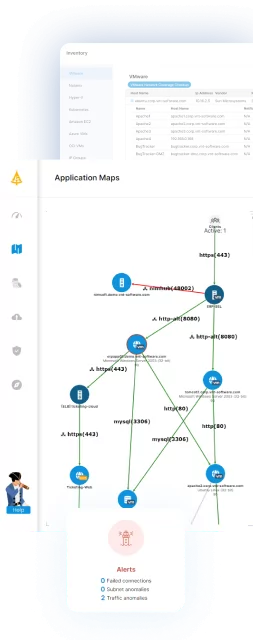

Preparing for DORA Compliance with Faddom

Navigating DORA compliance can be challenging, especially for organizations with complex IT environments and multiple third-party dependencies. Faddom’s application dependency mapping tool simplifies this process by providing complete visibility across hybrid infrastructures. It automatically discovers and maps all assets, applications, and interdependencies, ensuring a thorough inventory crucial for effective ICT risk management.

Faddom’s real-time monitoring helps identify vulnerabilities and potential risks, enabling proactive incident response and minimizing downtime. Its detailed documentation and reporting features support continuous compliance checks and governance under DORA. By automating these processes, Faddom reduces human error, saving time and resources, and making it easier for organizations to meet DORA’s standards before the 2025 deadline.

Learn more about becoming DORA compliant with Faddom by downloading our whitepaper here.