What Is the EU Digital Operational Resilience Act (DORA) Regulation?

The EU Digital Operational Resilience Act (DORA) is a regulatory framework aimed at ensuring the operational resilience of the financial sector in the European Union. It establishes requirements for financial entities to follow in order to withstand, respond, and recover from all types of disruptions and threats related to information and communication technology (ICT).

Introduced by the European Commission, DORA is part of the broader Digital Finance Package, which seeks to make financial services more digital and resilient against cyberattacks. It addresses gaps in existing regulations by setting uniform requirements for handling ICT risks across the financial sector, including banking, insurance, and investment firms.

This is part of an extensive series of guides about compliance management

Table of Contents

Toggle- What Is the EU Digital Operational Resilience Act (DORA) Regulation?

- The Purpose of DORA

- What Does DORA Cover? 5 Key Requirements

- Tips from the Expert

- What Does DORA Mean for UK Entities?

- DORA Enforcement and Timeline

- What Are the Penalties for Non-Compliance?

- DORA Compliance Checklist

- Preparing for DORA Compliance with Faddom

The DORA regulation entered into force on January 16, 2023. During 2023-4, various policy products are developed and submitted for public consultation. From 2025, the regulation will be fully applied and oversight activities begin.

The Purpose of DORA

DORA aims to improve the operational resilience of financial institutions by mandating ICT risk management procedures. The goal is to minimize the risk of disruptions in digital services that could impact financial stability and consumer protection. The regulation enforces a standard approach to managing ICT risks, ensuring that all financial entities are equipped to handle potential cyber threats efficiently.

Another objective of DORA is to foster better cooperation among financial entities, regulators, and third-party ICT service providers. By creating a coherent regulatory framework, DORA seeks to enhance transparency and accountability in the financial sector’s approach to digital resilience, protecting consumers and maintaining market confidence.

What Does DORA Cover? 5 Key Requirements

1. ICT Risk Management and Governance

Under DORA, financial institutions are required to implement ICT risk management frameworks. This includes conducting regular risk assessments, developing incident response plans, and ensuring senior management oversight. Institutions must also integrate ICT risk management into their overall risk management strategies, maintaining up-to-date documentation on their ICT systems and processes.

Governance plays an important role in DORA compliance. Financial entities must establish clear roles and responsibilities for ICT risk management, assigning accountability to senior executives. Regular training programs must be conducted to ensure staff are aware of and can act on ICT risk management policies and procedures effectively.

2. Incident Response and Reporting

DORA mandates that financial institutions have incident response and recovery plans. These plans should outline procedures for identifying, managing, and mitigating ICT incidents, ensuring minimal disruption to services. Institutions must also report significant incidents to relevant regulatory authorities promptly, providing detailed incident analyses and proposed corrective actions.

Regular testing and updating of incident response plans are crucial under DORA. Institutions must conduct post-incident reviews to identify lessons learned and improve their response strategies.

3. Digital Operational Resilience Testing

Financial institutions are required to conduct digital operational resilience tests to evaluate their preparedness against cyber threats. This includes vulnerability assessments, penetration testing, and scenario-based tests. These tests help identify weaknesses in ICT systems and allow institutions to address vulnerabilities before they can be exploited by actors.

DORA also emphasizes the need for testing methods such as threat-led penetration testing (TLPT). This involves simulating sophisticated cyberattacks to assess an institution’s defenses and response capabilities rigorously.

4. Third-Party Risk Management

Managing third-party risks is a component of DORA. Financial institutions must assess and monitor the ICT risks posed by third-party service providers, including cloud services and other outsourced technology solutions. This involves due diligence procedures, continuous monitoring, and setting clear contractual obligations regarding ICT risk management and incident reporting.

Institutions are also required to maintain an updated register of all third-party service providers and conduct regular risk assessments. This ensures that any potential vulnerabilities introduced by third-party services are identified and mitigated promptly.

5. Information Sharing

DORA encourages financial entities to share information related to cyber threats and incidents. This collaborative approach helps institutions learn from each other’s experiences, enhancing their overall resilience. Information sharing mechanisms are to be established to facilitate timely communication of threat intelligence and incident details among financial entities and regulatory bodies.

Formalizing information sharing practices aids in creating a unified defense front against cyber threats. By leveraging collective insights and expertise, financial institutions can better anticipate, prepare for, and respond to cyber risks, thus improving the entire sector’s operational resilience.

Lanir specializes in founding new tech companies for Enterprise Software: Assemble and nurture a great team, Early stage funding to growth late stage, One design partner to hundreds of enterprise customers, MVP to Enterprise grade product, Low level kernel engineering to AI/ML and BigData, One advisory board to a long list of shareholders and board members of the worlds largest VCs

Tips from the Expert

Tips from the expert:

In my experience, here are tips that can help you better adapt to the EU Digital Operational Resilience Act (DORA):

- Develop a cross-functional resilience team: Establish a team that includes members from IT, compliance, risk management, and business units. This interdisciplinary approach ensures comprehensive risk management and better alignment with DORA requirements.

- Adopt a zero-trust security model: Implement a zero-trust approach to cybersecurity, where every access request is verified, regardless of whether it comes from inside or outside the organization. This minimizes the risk of internal threats.

- Implement continuous compliance monitoring: Use automated tools to continuously monitor your compliance status. This helps in identifying non-compliance issues in real-time, allowing for swift remediation.

- Integrate DORA compliance into corporate culture: Embed DORA compliance into the company’s culture by ensuring all employees understand its importance and their role in maintaining operational resilience. Regular workshops and updates can help maintain awareness.

Establish a cyber resilience dashboard: Create a dashboard that provides real-time visibility into your organization’s cyber resilience status. This can help senior management make informed decisions quickly during a cyber incident.

What Does DORA Mean for UK Entities?

For UK-based financial entities, DORA has implications. Although the UK is no longer part of the EU, many UK financial institutions operate within the European market and must comply with DORA’s requirements. This requires aligning their ICT risk management and operational resilience frameworks with DORA’s standards to ensure cross-border operations.

Additionally, UK entities must stay informed about any changes or updates to DORA to remain compliant and competitive. By adhering to DORA’s regulatory framework, UK institutions can demonstrate their commitment to operational resilience, fostering trust and confidence among clients and stakeholders.

Learn more in our detailed guide to DORA regulation UK

DORA Enforcement and Timeline

The implementation of the Digital Operational Resilience Act (DORA) follows a structured timeline to enable gradual adoption across the financial sector.

The timeline is divided into key phases involving legislative actions and consultations led by the three European Supervisory Authorities (ESAs):

- European Banking Authority (EBA)

- European Insurance and Occupational Pensions Authority (EIOPA)

- European Securities and Markets Authority (ESMA)

Key dates and milestones of the DORA regulation:

- 16 January 2023: Entry into force of DORA.

- 26 May – 23 June 2023: Public consultation on the call for advice concerning criticality criteria and fees.

- 19 June – 11 September 2023: Public consultation on the first batch of policy products, covering articles 15, 16(3), 18(3), 28(9), and 28(10) of DORA.

- 30 September 2023: Submission of advice on criticality criteria and fees.

- 8 December 2023 – 4 March 2024: Public consultation on the second batch of policy products, addressing articles 11(11), 20a, 20b, 26(11), 30(5), 32(7), and 41 of DORA.

- 17 January 2024: Delivery of the first batch of policy products.

- 17 July 2024: Delivery of the second batch of policy products.

- 17 January 2025: Full application of DORA commences.

- From 2025 onwards: Start of oversight activities by ESAs, including the designation of critical third-party providers (CTPPs).

What Are the Penalties for Non-Compliance?

Penalties for non-compliance with the Digital Operational Resilience Act (DORA) are stringent and enforceable by designated regulators in each EU member state, known as “competent authorities.” Potential consequences for non-compliance include administrative fines, mandatory remedial measures, public reprimands, withdrawal of authorization to operate, and compensation for damages incurred due to breaches.

A breach of DORA requirements could result in fines of up to 2% of the total annual worldwide turnover, or or up to 1% of average daily worldwide turnover. Individuals and companies can face fines of up to €1 million. Critical third-party ICT service providers used by financial entities can incur even higher fines, up to €5 million for companies or €500,000 for individuals.

DORA Compliance Checklist

1. Perform a DORA Gap Analysis

A crucial first step towards DORA compliance is conducting a thorough gap analysis. This involves reviewing existing ICT risk management frameworks to identify areas that fall short of DORA’s requirements. Institutions must evaluate their current practices against the regulatory standards, highlighting deficiencies and areas that need improvement.

A detailed gap analysis provides a roadmap for achieving compliance. It helps financial entities prioritize their efforts, ensuring that critical gaps are addressed promptly while also aligning their strategies with DORA’s operational resilience objectives.

2. Create a Remediation Roadmap

Following the gap analysis, institutions must develop a remediation roadmap. This outlines specific actions and timelines for addressing identified gaps and achieving full compliance with DORA. The roadmap should include milestones, responsible parties, and resource allocations, ensuring a structured approach to implementing necessary changes.

Continuous monitoring and updates to the remediation roadmap are essential to accommodate any changes in regulatory requirements or emerging threats.

3. Implement a Threat-Led Penetration Testing Framework (TLPT)

To meet DORA’s testing requirements, institutions should implement a threat-led penetration testing (TLPT) framework. This involves simulating sophisticated cyberattacks to identify vulnerabilities and assess the institution’s defense mechanisms. TLPT provides valuable insights into the effectiveness of existing security measures and highlights areas that need reinforcement.

Regular TLPT exercises are critical for maintaining a high level of operational resilience. Financial entities must ensure that their ICT systems undergo periodic and rigorous testing, adapting their strategies based on the findings to stay ahead of evolving cyber threats.

4. Assess Incident Response and Recovery Strategies

Assessing and enhancing incident response and recovery strategies is vital under DORA. Institutions must regularly review their plans to ensure they can handle ICT incidents and minimize service disruptions. This involves testing response procedures, conducting post-incident analyses, and updating strategies based on lessons learned.

Effective incident response and recovery strategies are essential for maintaining operational continuity. By proactively assessing and improving these plans, financial entities can safeguard their operations against ICT disruptions and comply with DORA’s regulatory requirements.

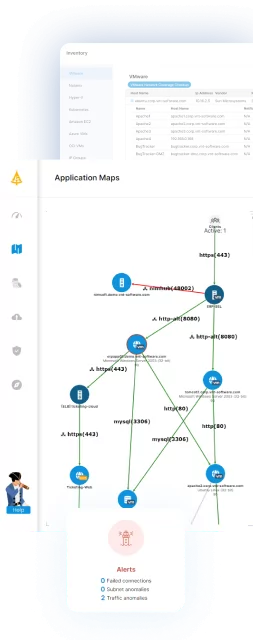

Preparing for DORA Compliance with Faddom

Navigating DORA compliance can be challenging, especially for organizations with complex IT environments and multiple third-party dependencies. Faddom’s application dependency mapping tool simplifies this process by providing complete visibility across hybrid infrastructures. It automatically discovers and maps all assets, applications, and interdependencies, ensuring a thorough inventory crucial for effective ICT risk management.

Faddom’s real-time monitoring helps identify vulnerabilities and potential risks, enabling proactive incident response and minimizing downtime. Its detailed documentation and reporting features support continuous compliance checks and governance under DORA. By automating these processes, Faddom reduces human error, saving time and resources, and making it easier for organizations to meet DORA’s standards before the 2025 deadline.

Learn more about becoming DORA compliant with Faddom by downloading our whitepaper here.

See Additional Guides on Key Compliance Management Topics

Together with our content partners, we have authored in-depth guides on several other topics that can also be useful as you explore the world of compliance management.

HIPAA Compliant Hosting

Authored by Atlantic

- [Guide] HIPAA-Compliant Hosting | 2025 Award Winning HIPAA Hosting

- [Guide] What is Protected Health Information (PHI) in 2025? Atlantic.Net

- [Blog] RTLS and Healthcare

- [Product] Atlantic.Net HIPAA Compliant Hosting

Health Data Management

Authored by Cloudian

- [Guide] What is Health Data Management? Benefits, Challenges and Storage

- [Guide] HIPAA Compliant Cloud Storage and On-Premises Alternatives

- [Product] HyperStore Object Storage

GDPR Compliance

Authored by Exabeam